Creating a business plan and financial projections is a critical step for any entrepreneur looking to secure funding for their business. A well-crafted business plan demonstrates to potential investors and lenders that the entrepreneur has a clear understanding of their market, competition, and financial needs, and a solid plan for achieving success. In this article, we will discuss the importance of creating a comprehensive business plan and accurate financial projections, and provide tips and resources for entrepreneurs to help them create a successful plan.

Executive Summary

The Executive Summary is the first section of a business plan, and it’s often the only part that investors and lenders read. It’s important to make a good first impression, and the Executive Summary should be clear, concise, and compelling. It should provide an overview of the business, the market, and the financial projections.

Best Practices for an Effective Executive Summary

- Keep it brief, usually no more than one page.

- Highlight the key elements of the business plan, such as the market opportunity, the competitive landscape, and the financial projections.

- Use clear, simple language that is easy for anyone to understand.

- Include a call to action, such as requesting a meeting to discuss the business plan in more detail.

Example of an Executive Summary

Acme Inc. is a new company that has developed a revolutionary product that solves a common problem in the XYZ industry. Our product is patent pending and we have already secured commitments for $500,000 in seed funding. We are seeking an additional $2 million in funding to bring the product to market and scale production.

The XYZ industry is a $5 billion market and growing at a rate of 8% per year. Our product addresses a specific need in the market that is currently unmet by any existing products. We have identified several key customers and have already secured commitments from several of them.

Acme Inc. will use the funding to complete the final stages of product development, launch marketing and sales campaigns, and scale production to meet initial demand. We expect to generate $10 million in revenue in the first year, with a projected profit margin of 20%.

In conclusion, Acme Inc. has developed a revolutionary product that addresses a specific need in a growing market. We have a strong team, a clear plan, and the support of key customers. We are seeking funding to bring the product to market and scale production to meet initial demand.

Tips for Creating Accurate Financial Projections

- Use industry data and market research to develop realistic projections.

- Be conservative in your estimates. It’s better to underpromise and overdeliver.

- Include a sensitivity analysis to show how the projections change under different scenarios.

- Be prepared to explain and defend your projections to investors and lenders.

It’s important to remember that a business plan is a living document. It should be reviewed and updated regularly as the business evolves and market conditions change. By creating a comprehensive business plan and accurate financial projections, entrepreneurs are more likely to secure funding and achieve success in their business.

Market analysis

Market analysis is a critical component of a comprehensive business plan. It helps entrepreneurs understand their target market, the size and growth potential of that market, and the competitive landscape. A thorough market analysis can help entrepreneurs identify opportunities for growth and differentiation, and it can also help them identify potential risks and challenges.

Best Practices for Market Analysis

- Define your target market clearly, including demographic information and buying habits.

- Research the size and growth potential of the market. Look for data on industry trends, sales, and market share.

- Identify your competitors, including both direct and indirect competitors. Analyze their strengths and weaknesses.

- Look for opportunities for differentiation, such as unmet customer needs or untapped market segments.

Example of a Market Analysis

Acme Inc. is a company that has developed a revolutionary product that solves a common problem in the XYZ industry. Our target market is small and medium-sized businesses (SMBs) in the XYZ industry. This market is estimated to be worth $5 billion and is growing at a rate of 8% per year.

The XYZ industry is currently dominated by a few large players, but there is also a significant number of smaller, niche players. Our product addresses a specific need in the market that is currently unmet by any existing products. We have identified several key customers and have already secured commitments from several of them.

Competitive landscape analysis shows that there are no existing products that can match our features and price point. However, we do have indirect competitors that offer similar solutions but are not as efficient or cost-effective.

In conclusion, the market for Acme Inc.’s product is a large and growing one. There is a clear need for our product in the market, and we have identified key customers who are committed to purchasing it. Our product has no direct competition, and our indirect competition is not as efficient or cost-effective as our product. We believe that this represents a significant opportunity for growth and differentiation.

Tips for Conducting Market Analysis

- Use data and research to back up your assumptions about the market.

- Be realistic about the size of the market and the potential for growth.

- Be honest about the competitive landscape and the challenges that you may face.

- Use the market analysis to identify opportunities for differentiation and growth.

The market analysis is an essential part of the business plan and is important for securing funding. It will help entrepreneurs understand the market and competition, and identify opportunities for growth and differentiation. By conducting a thorough market analysis, entrepreneurs can create a more effective business plan and increase their chances of success.

Industry and Competitive analysis

Industry and competitive analysis are key components of a comprehensive business plan. They help entrepreneurs understand the industry landscape and position their business for success. Industry analysis provides an overview of the industry, including trends, growth potential, and major players. Competitive analysis, on the other hand, helps entrepreneurs understand their competitors, including both direct and indirect competitors, and their strengths and weaknesses.

Best Practices for Industry and Competitive Analysis

- Research the industry and identify key trends, growth potential, and major players.

- Use data to understand the size and growth potential of the market.

- Identify both direct and indirect competitors, and understand their strengths and weaknesses.

- Use the information gathered to position your business for success and identify opportunities for differentiation.

Example of Industry and Competitive Analysis

Acme Inc. operates in the XYZ industry, which is a $5 billion market and growing at a rate of 8% per year. The industry is currently dominated by a few large players, but there is also a significant number of smaller, niche players. The industry has been growing steadily in recent years, driven by increasing demand for XYZ products and services.

Our main competitors are other companies offering similar products and services in the XYZ industry. We have identified several direct competitors and several indirect competitors, such as companies offering different solutions but targeting the same customers. We have analyzed their strengths and weaknesses and we have found that our product offers unique features and benefits that are not offered by any other competitors.

In terms of positioning, we have identified a specific market segment that is currently unmet by existing products and services. We have already secured commitments from several key customers in this market segment, which demonstrates the potential for success. We believe that our unique features and benefits, along with our strategic positioning in the market, will allow us to stand out from the competition and achieve success in the industry.

Tips for Conducting Industry and Competitive Analysis

- Use data and research to back up your assumptions about the industry and competition.

- Be realistic about the size of the market and the potential for growth.

- Be honest about the competitive landscape and the challenges that you may face.

- Use the information gathered to position your business for success and identify opportunities for differentiation.

In conclusion, industry and competitive analysis are critical components of a comprehensive business plan. They help entrepreneurs understand the industry landscape and position their business for success. By conducting a thorough industry and competitive analysis, entrepreneurs can create a more effective business plan, identify opportunities for differentiation and growth, and increase their chances of success in the industry. Remember to use data and research to back up your assumptions, be realistic about the market, and use the information to position your business for success.

Product or Service description

The product or service description is a critical component of a comprehensive business plan. It details the unique value proposition of the business, including the features and benefits of the product or service, and how it addresses the needs of the target market. A clear and compelling product or service description is essential for securing funding and attracting customers.

Best Practices for Product or Service Description

- Clearly and concisely describe the features and benefits of your product or service.

- Explain how your product or service addresses the needs of your target market.

- Include any relevant information about patents, trademarks, or other proprietary information.

- Use customer testimonials or quotes to support your claims about the product or service.

Example of a Product or Service Description

Acme Inc. has developed a revolutionary product that solves a common problem in the XYZ industry. Our product, named “ABC”, is a cutting-edge solution that offers several unique features and benefits that are not available in any other existing products.

ABC offers a unique combination of features and benefits that addresses the needs of small and medium-sized businesses (SMBs) in the XYZ industry. Our product is highly efficient, cost-effective and easy to use. It offers a range of advanced features that enable our customers to streamline their operations and increase productivity.

Our product is protected by a patent, which provides a competitive advantage in the market. Additionally, we have received positive feedback and testimonials from several key customers, which confirms the effectiveness of our product.

Tips for Creating a Product or Service Description

- Keep it simple and easy to understand.

- Highlight the unique features and benefits of your product or service.

- Explain how your product or service addresses the needs of your target market.

- Include any relevant information about patents, trademarks, or other proprietary information.

In conclusion, the product or service description is a critical component of a comprehensive business plan. It details the unique value proposition of the business, including the features and benefits of the product or service, and how it addresses the needs of the target market. A clear and compelling product or service description is essential for securing funding and attracting customers.

Sales and Marketing strategy

A sales and marketing strategy is a critical component of a comprehensive business plan. It outlines how a business will reach and engage its target market, generate leads and convert them into customers. A well-crafted sales and marketing strategy can help a business stand out from the competition and achieve success in the market.

Best Practices for Sales and Marketing Strategy

- Clearly define your target market and understand their needs and pain points.

- Identify the most effective channels for reaching and engaging your target market.

- Develop a clear and compelling value proposition that sets your business apart from the competition.

- Use data and analytics to track and measure the effectiveness of your sales and marketing efforts.

Example of a Sales and Marketing Strategy

Acme Inc. will use a multi-channel sales and marketing strategy to reach and engage its target market. Our target market is small and medium-sized businesses (SMBs) in the XYZ industry, and we have identified several key pain points that our product, “ABC”, addresses.

We will use a combination of digital marketing, in-person sales, and strategic partnerships to reach and engage our target market. Our digital marketing efforts will focus on targeted advertising and content marketing, using channels such as Google AdWords, LinkedIn, and industry-specific websites. Additionally, our sales team will focus on building relationships with key decision-makers at SMBs in the XYZ industry, through in-person sales calls and networking events.

We will also develop strategic partnerships with complementary businesses and organizations, such as consulting firms and industry associations, to reach and engage our target market. Our partnerships will provide us with access to a larger audience, as well as valuable resources and expertise.

We will use data and analytics to track and measure the effectiveness of our sales and marketing efforts. We will regularly review metrics such as website traffic, conversion rates, and customer acquisition costs to optimize our strategy and achieve better results.

Tips for Creating a Sales and Marketing Strategy

- Clearly define your target market and understand their needs and pain points.

- Identify the most effective channels for reaching and engaging your target market.

- Develop a clear and compelling value proposition that sets your business apart from the competition.

- Use data and analytics to track and measure the effectiveness of your sales and marketing efforts.

In conclusion, a sales and marketing strategy is a critical component of a comprehensive business plan. It outlines how a business will reach and engage its target market, generate leads and convert them into customers. A well-crafted sales and marketing strategy can help a business stand out from the competition and achieve success in the market. Remember to clearly define your target market, identify effective channels for reaching them, develop a compelling value proposition, and use data and analytics to measure the effectiveness of your efforts.

It is important to note that, the sales and marketing strategy should be aligned with the overall goals and objectives of the business, as well as the budget and resources available. It should also be flexible and adaptable, as the market and customer needs may change over time. Regularly reviewing and updating the sales and marketing strategy will help ensure its effectiveness and long-term success.

In summary, creating a comprehensive business plan that includes a clear and compelling product or service description, market analysis, industry and competitive analysis, sales and marketing strategy and financial projections is an essential step for any entrepreneur looking to start or grow a business. It can help you understand the industry landscape and position your business for success. It also can help you to secure funding and attract customers.

Operations and Management plan

An operations and management plan is a critical component of a comprehensive business plan. It outlines the processes and procedures that a business will use to operate and manage its day-to-day activities. A well-crafted operations and management plan can help a business streamline its processes, increase efficiency, and achieve long-term success.

Best Practices for Operations and Management Plan

- Clearly define and document all processes and procedures.

- Identify and mitigate potential risks.

- Continuously improve processes through data-driven decision making

- Develop a system for monitoring and measuring performance

- Provide clear roles and responsibilities for each team member

Example of an Operations and Management Plan

Acme Inc. has developed a comprehensive operations and management plan to streamline its processes and increase efficiency. Our plan includes the following key elements:

- Process documentation: We have clearly defined and documented all processes and procedures, including those related to production, inventory management, and customer service. This allows us to easily train new employees and ensure consistency across the organization.

- Risk management: We have identified potential risks and developed mitigation strategies to minimize their impact on the business. For example, we have implemented a robust inventory management system to prevent stockouts and ensure that we always have the products our customers need.

- Continuous improvement: We use data-driven decision making to continuously improve our processes. We regularly review metrics such as production efficiency, customer satisfaction, and inventory turnover to identify areas for improvement and implement changes accordingly.

- Performance monitoring: We have developed a system for monitoring and measuring performance across the organization. This allows us to identify areas of the business that are performing well and those that need improvement. We use this data to make data-driven decisions and implement necessary changes to improve overall performance.

- Clear roles and responsibilities: We have clearly defined roles and responsibilities for each team member. This ensures that everyone knows what is expected of them and that there is no overlap or confusion. This also improves accountability and productivity.

Tips for Creating an Operations and Management Plan

- Clearly define and document all processes and procedures.

- Identify and mitigate potential risks.

- Continuously improve processes through data-driven decision making

- Develop a system for monitoring and measuring performance

- Provide clear roles and responsibilities for each team member

In conclusion, an operations and management plan is a critical component of a comprehensive business plan. It outlines the processes and procedures that a business will use to operate and manage its day-to-day activities. A well-crafted operations and management plan can help a business streamline its processes, increase efficiency, and achieve long-term success. It’s important to have clear defined processes and procedures, identify and mitigate potential risks, continuously improve through data-driven decision making, have a system in place to monitor and measure performance, and assign clear roles and responsibilities to each team member. This will help to ensure smooth operations and efficient management of the business.

Financial projections and historical financials

Financial projections and historical financials are a vital component of any comprehensive business plan. They provide a detailed picture of the financial health and potential of a business, and can be used to secure funding and attract investors.

Best Practices for Financial Projections and Historical Financials

- Use realistic and conservative assumptions

- Include detailed breakdowns of revenue, expenses, and cash flow

- Use industry benchmarks and trends to inform projections

- Update projections regularly to reflect changes in the business

- Include historical financials to provide context and credibility

Example of Financial Projections and Historical Financials Acme Inc. has developed detailed financial projections and historical financials to demonstrate the financial potential and stability of the business. Our projections include:

- Revenue projections: We have projected revenue for the next three years, based on conservative assumptions about market growth and customer acquisition. We have also included detailed breakdowns of revenue by product and service line.

- Expense projections: We have projected expenses for the next three years, including costs for labor, materials, and overhead. We have also included detailed breakdowns of expenses by category.

- Cash flow projections: We have projected cash flow for the next three years, taking into account revenue, expenses, and any financing or investment activities.

- Historical financials: We have provided historical financials for the past three years, including income statements, balance sheets, and cash flow statements. This provides context and credibility to our projections.

Tips for Creating Financial Projections and Historical Financials

- Use realistic and conservative assumptions

- Include detailed breakdowns of revenue, expenses, and cash flow

- Use industry benchmarks and trends to inform projections

- Update projections regularly to reflect changes in the business

- Include historical financials to provide context and credibility

In conclusion, Financial projections and historical financials are a vital component of any comprehensive business plan. They provide a detailed picture of the financial health and potential of a business, and can be used to secure funding and attract investors. It is important to use realistic and conservative assumptions, include detailed breakdowns of revenue, expenses, and cash flow, use industry benchmarks and trends to inform projections, update projections regularly to reflect changes in the business, and include historical financials to provide context and credibility. This will help to ensure that your projections are accurate and credible, and that they can be used to secure funding and attract investors.

Break-even analysis

Break-even analysis is a financial tool that helps entrepreneurs understand the point at which their business will begin to generate a profit. It is a critical component of any comprehensive business plan and can be used to determine the minimum sales volume required to cover all costs and generate a profit.

Best Practices for Break-Even Analysis

- Accurately estimate all fixed and variable costs

- Use realistic sales volume and pricing assumptions

- Regularly update the analysis to reflect changes in costs or sales

- Use the analysis to identify potential cost savings or pricing strategies

- Use the analysis to make informed decisions about investment and expansion

Example of Break-Even Analysis Acme Inc. has conducted a break-even analysis to understand the point at which the business will begin to generate a profit. Our analysis includes:

- Cost estimates: We have accurately estimated all fixed and variable costs, including labor, materials, and overhead.

- Sales volume and pricing assumptions: We have used realistic assumptions about sales volume and pricing to determine the minimum sales volume required to cover costs and generate a profit.

- Break-even point: Using our cost and sales assumptions, we have determined that we need to generate $100,000 in sales to reach our break-even point.

- Cost savings and pricing strategies: We have used the analysis to identify potential cost savings and pricing strategies that can help us reach our break-even point more quickly. For example, we have identified ways to reduce our labor costs or increase our prices to improve our bottom line.

- Investment and expansion decisions: We have used the analysis to make informed decisions about investment and expansion. For example, if we determine that we need to generate $150,000 in sales to reach our break-even point, we may decide to invest in more aggressive marketing campaigns or expand our product line to increase sales.

Tips for Conducting a Break-Even Analysis

- Accurately estimate all fixed and variable costs

- Use realistic sales volume and pricing assumptions

- Regularly update the analysis to reflect changes in costs or sales

- Use the analysis to identify potential cost savings or pricing strategies

- Use the analysis to make informed decisions about investment and expansion

In conclusion, Break-even analysis is a financial tool that helps entrepreneurs understand the point at which their business will begin to generate a profit. It’s important to accurately estimate all fixed and variable costs, use realistic sales volume and pricing assumptions, regularly update the analysis to reflect changes in costs or sales, use the analysis to identify potential cost savings or pricing strategies, and use the analysis to make informed decisions about investment and expansion. This will help entrepreneurs understand their business’s financial thresholds and make informed decisions about investment and expansion.

Investment and funding requirements

Securing funding and investment is a critical step for any entrepreneur looking to start or scale their business. In order to secure the capital you need, it’s important to understand your funding options and create a clear, compelling investment proposal.

Best Practices for Investment and Funding Requirements

- Understand your funding options: Research the different types of funding available to your business, including loans, grants, and equity investments.

- Create a detailed business plan: A comprehensive business plan that includes financial projections, market analysis, and a clear explanation of your product or service will be essential when seeking funding from investors or lenders.

- Network and build relationships: Building relationships with potential investors, lenders, or partners can help you secure funding for your business.

- Be prepared to give equity: Be prepared to give up a percentage of ownership in your business in exchange for funding, especially if you’re seeking equity investment.

- Be realistic about funding requirements: Be realistic about the amount of funding you need to launch or scale your business.

Example of Investment and Funding Requirements Acme Inc. is seeking $500,000 in funding to launch our new product line. Our funding requirements include:

- Researching funding options: We have researched the different types of funding available to our business, including loans, grants, and equity investments.

- Creating a detailed business plan: We have created a comprehensive business plan that includes financial projections, market analysis, and a clear explanation of our product or service.

- Networking and building relationships: We have been building relationships with potential investors, lenders, or partners to help us secure funding for our business.

- Preparing to give equity: We are prepared to give up a percentage of ownership in our business in exchange for funding, especially if we’re seeking equity investment.

- Being realistic about funding requirements: We are being realistic about the amount of funding we need to launch our product line.

Tips for Securing Investment and Funding

- Understand your funding options

- Create a detailed business plan

- Network and build relationships

- Be prepared to give equity

- Be realistic about funding requirements

In conclusion, securing funding and investment is a critical step for any entrepreneur looking to start or scale their business. It’s important to understand your funding options, create a detailed business plan, network and build relationships, be prepared to give equity, and be realistic about funding requirements. By following these best practices and tips, you can increase your chances of securing the capital your business needs to succeed.

Exit strategy

An exit strategy is a plan for how and when a business owner will leave their business, whether it’s through a sale, merger, or transfer of ownership. It’s an important aspect of any business plan, as it helps entrepreneurs plan for the future of their business and maximize the value of their investment.

Best Practices for Exit Strategy

- Start planning early: The earlier you start planning for your exit, the more time you’ll have to prepare and position your business for a successful transition.

- Identify potential buyers: Identify potential buyers or partners early on, so you can start building relationships and positioning your business for a sale or merger.

- Consider multiple exit options: Consider multiple exit options, such as a sale to a strategic buyer, a sale to a financial buyer, or a transfer of ownership to a family member or employee.

- Continuously improve the business: Continuously work on improving your business, so that it’s more attractive to potential buyers and can fetch a higher price.

- Get professional advice: Seek advice from a business broker, attorney, or other professional to help you navigate the process and maximize the value of your business.

Example of Exit Strategy ABC Inc. has been in business for 10 years and the owner, John, is starting to think about retirement. John’s exit strategy includes:

- Starting to plan early: John started planning for his exit several years ago, so he has plenty of time to prepare and position his business for a successful transition.

- Identifying potential buyers: John has identified potential buyers, such as strategic buyers in his industry and financial buyers who are interested in his business’s cash flow.

- Considering multiple exit options: John is considering multiple exit options, including a sale to a strategic buyer, a sale to a financial buyer, or a transfer of ownership to a family member or employee.

- Continuously improving the business: John is continuously working on improving his business, so that it’s more attractive to potential buyers and can fetch a higher price.

- Seeking professional advice: John is seeking advice from a business broker, attorney, and other professionals to help him navigate the process and maximize the value of his business.

Tips for Developing an Exit Strategy

- Start planning early

- Identify potential buyers

- Consider multiple exit options

- Continuously improve the business

- Seek professional advice

In conclusion, an exit strategy is a plan for how and when a business owner will leave their business. It’s an important aspect of any business plan, as it helps entrepreneurs plan for the future of their business and maximize the value of their investment. In order to develop a solid exit strategy, entrepreneurs should start planning early, identify potential buyers, consider multiple exit options, continuously improve the business and seek professional advice. By considering all these aspects, entrepreneurs can ensure a smooth transition and maximize the value of their business for the benefit of themselves and all stakeholders involved.

Appendices: Supporting documents to strengthen your business plan

The appendices of a business plan are a section where entrepreneurs can include additional information that supports and strengthens the rest of the plan. This section can include a variety of documents, such as resumes of key team members, letters of support or commitment, market research data, financial projections, and other relevant information.

Best Practices for Appendices

- Keep it relevant: Only include information that is directly relevant to your business plan and supports the claims and projections made in the rest of the plan.

- Keep it organized: Organize the appendices in a logical and easy-to-follow manner, with clear headings and subheadings to make it easy for the reader to find the information they need.

- Use professional formatting: Use professional formatting and design to make the appendices look polished and professional.

Examples of Appendices

- Resumes of key team members: Include the resumes of key team members, such as the CEO, CFO, and other key executives, to showcase their qualifications and experience.

- Letters of support or commitment: Include letters of support or commitment from partners, suppliers, and other important stakeholders to demonstrate the level of support for your business and your ability to secure important partnerships or agreements.

- Market research data: Include any market research data you’ve gathered, such as surveys or focus group results, to support your market analysis and show that you’ve done your homework.

- Financial projections: Include detailed financial projections, such as projected income statements, balance sheets, and cash flow statements, to support your financial analysis and demonstrate your ability to manage your business’s finances.

Tips for Appendices

- Keep it relevant

- Keep it organized

- Use professional formatting

In conclusion, the appendices of a business plan provide an opportunity for entrepreneurs to include additional information that supports and strengthens the rest of the plan. It is important to include relevant information, keep it organized and use professional formatting to make the appendices look polished and professional. This will help to demonstrate the level of support for your business and your ability to secure important partnerships or agreements, as well as your ability to manage your business’s finances.

SWOT analysis

A SWOT analysis is a tool entrepreneurs can use to evaluate the internal and external factors that can impact the success of their business. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and it helps entrepreneurs identify the areas where their business excels, as well as areas where it may need improvement. It also helps entrepreneurs identify potential opportunities and threats that could impact their business in the future.

Best Practices for SWOT Analysis

- Be honest and objective: Be honest and objective when evaluating your business, and don’t be afraid to identify areas where your business needs improvement.

- Look at both internal and external factors: Consider both internal factors, such as your business’s strengths and weaknesses, and external factors, such as market trends and competition.

- Use the information to develop a strategic plan: Use the information from your SWOT analysis to develop a strategic plan that addresses your business’s strengths, weaknesses, opportunities, and threats.

Examples of SWOT Analysis

- A coffee shop’s strengths might include a prime location, a loyal customer base, and a strong brand. Weaknesses might include a lack of a drive-thru and limited seating capacity. Opportunities might include the growth of the specialty coffee market, and threats might include increased competition from other coffee shops in the area.

- A software company’s strengths might include a strong development team, a patent for a key technology, and a well-established customer base. Weaknesses might include a lack of sales and marketing expertise, and limited resources. Opportunities might include the growing trend of cloud computing, and threats might include increased competition from larger, established companies.

Tips for SWOT Analysis

- Be honest and objective

- Look at both internal and external factors

- Use the information to develop a strategic plan

In conclusion, SWOT analysis is a valuable tool for entrepreneurs to identify their business’s strengths, weaknesses, opportunities, and threats. It helps in developing a strategic plan that addresses the areas where their business excels, as well as areas where it may need improvement. It also helps entrepreneurs identify potential opportunities and threats that could impact their business in the future. By being honest and objective, and considering both internal and external factors, entrepreneurs can use the information from their SWOT analysis to develop a strategic plan that will help them achieve success.

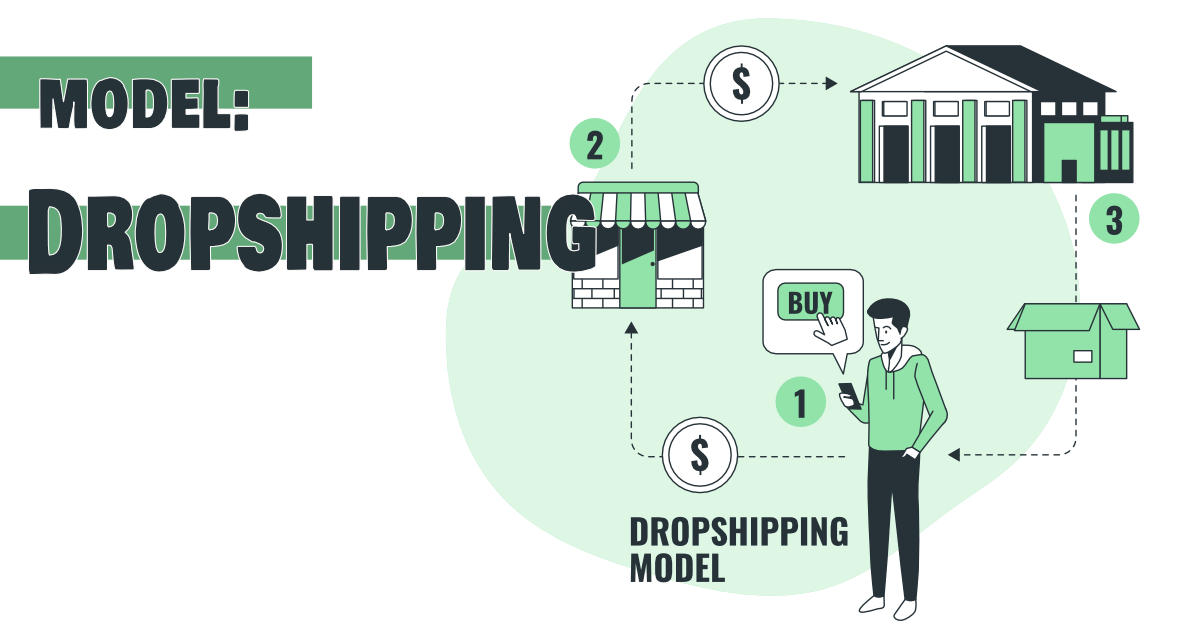

Business Model Canvas

The Business Model Canvas is a visual tool that entrepreneurs can use to map out the key elements of their business model. It helps entrepreneurs understand the different components of their business, and how they interact with each other. The canvas is divided into nine building blocks: customer segments, value proposition, channels, customer relationships, revenue streams, key resources, key activities, key partners, and cost structure.

Best Practices for Using the Business Model Canvas

- Keep it simple: The Business Model Canvas is meant to be a simple, easy-to-use tool. Keep your canvas simple and avoid adding too much detail.

- Be flexible: Be prepared to change your canvas as your business evolves. Your business model will change over time, and your canvas should reflect that.

- Get feedback: Share your canvas with others and get feedback. Other people may have valuable insights that you hadn’t considered.

Examples of Business Model Canvas

- An online clothing retailer’s customer segments might include men, women, and children. Their value proposition might be providing a wide selection of clothing at competitive prices, delivered quickly. Their channels might include their website, social media, and email marketing. Their customer relationships might include a loyalty program and personalized recommendations. Their revenue streams might include sales of clothing and accessories, as well as advertising. Their key resources might include their website, inventory, and delivery fleet. Their key activities might include product development, marketing, and fulfillment. Their key partners might include clothing manufacturers and delivery companies. Their cost structure might include the cost of goods, marketing, and fulfillment expenses.

- A ride-sharing company’s customer segments might include urban residents and tourists. Their value proposition might be providing safe, reliable, and convenient transportation. Their channels might include their app and website. Their customer relationships might include a rating system and driver feedback. Their revenue streams might include fares and advertising. Their key resources might include their app, drivers, and cars. Their key activities might include recruiting drivers, maintaining the app, and managing the dispatch system. Their key partners might include car rental companies and insurance providers. Their cost structure might include driver payments, insurance, and app development expenses.

Tips for Business Model Canvas

- Keep it simple

- Be flexible

- Get feedback

In conclusion, the Business Model Canvas is a valuable tool for entrepreneurs. It helps them understand the different components of their business, and how they interact with each other. By keeping it simple, being flexible, and getting feedback, entrepreneurs can use the Business Model Canvas to develop a clear, actionable plan for their business. With this tool, they can quickly identify and adjust key aspects of their business model, and be more prepared to achieve success.

Risk Management

As an entrepreneur, it’s important to anticipate and manage risks that could potentially harm your business. Risk management is the process of identifying, assessing, and prioritizing risks and then implementing strategies to mitigate or eliminate them. By managing risks effectively, entrepreneurs can protect their investments, reputation, and overall well-being of their business.

Best Practices for Risk Management

- Identify risks early: The earlier you identify a risk, the more time you have to develop a strategy to mitigate it.

- Prioritize risks: Not all risks are created equal. Prioritize the risks that have the potential to cause the most damage.

- Develop a risk management plan: Create a plan that outlines the steps you will take to mitigate or eliminate each risk.

Examples of Risks for Entrepreneurs

- Financial risks: These include risks related to cash flow, funding, and investments. For example, a lack of funding could make it difficult to grow your business.

- Market risks: These include risks related to changes in the market, competition, and customer demand. For example, a new competitor entering the market could make it difficult for your business to compete.

- Operational risks: These include risks related to the day-to-day operations of your business. For example, a natural disaster could disrupt your supply chain.

Tips for Risk Management

- Identify risks early

- Prioritize risks

- Develop a risk management plan

In conclusion, risk management is an important part of being an entrepreneur. By identifying and assessing risks early, prioritizing them, and developing a plan to mitigate them, entrepreneurs can protect their investments and reputation and increase their chances of success. It’s also important to review and update the risk management plan regularly to ensure that it stays relevant as the business evolves.

Traction and Milestones

As an entrepreneur, it’s essential to have a clear understanding of the traction and milestones you need to achieve in order to scale your business. Traction refers to the measurable progress a business is making towards achieving its goals, while milestones are specific, time-bound goals that a business sets to measure its progress. By setting and achieving traction and milestones, entrepreneurs can measure their progress, identify areas that need improvement, and make data-driven decisions.

Best Practices for Achieving Traction and Milestones

- Set clear and measurable goals: Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Prioritize milestones: Not all milestones are created equal. Prioritize the milestones that have the greatest impact on your business.

- Track progress and adjust accordingly: Continuously track your progress and make adjustments as needed.

Examples of Traction and Milestones for Entrepreneurs

- Financial traction: This includes milestones such as reaching profitability, securing funding, or achieving a certain revenue or profit margin.

- Market traction: This includes milestones such as acquiring a certain number of customers, increasing market share, or reaching a certain level of brand awareness.

- Operational traction: This includes milestones such as improving production efficiency, reducing costs, or increasing the scalability of your business.

Tips for Achieving Traction and Milestones

- Set clear and measurable goals

- Prioritize milestones

- Track progress and adjust accordingly

In conclusion, achieving traction and milestones is an important part of growing a successful business. By setting clear and measurable goals, prioritizing milestones, and continuously tracking progress and adjusting as needed, entrepreneurs can measure their progress, identify areas that need improvement, and make data-driven decisions. This will help entrepreneurs to stay on track and achieve success.